On 1/May, Japanese Government started to accept applications of "持続化給付金" or JIZOKUKA-KYUFUKIN, じぞくかきゅうふきん for the companies suffer from Sales decrease due to COVID-19. The Government pays up to 2 million yen for an incorporated SME or 1 million yen for a non-incorporated self-employed persons where applicable.

In this article, you will see the overview of the benefit program.

スポンサーリンク

What is "持続化給付金" or JIZOKUKA-KYUFUKIN じぞくかきゅうふきん

The points

- The Government pays up to 2 million yen for an incorporateEnterd SME or 1 million yen for a non-incorporated self-employed persons.

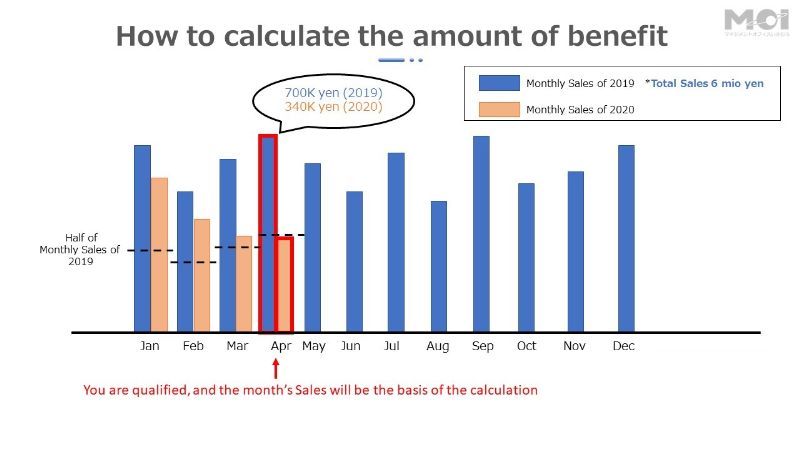

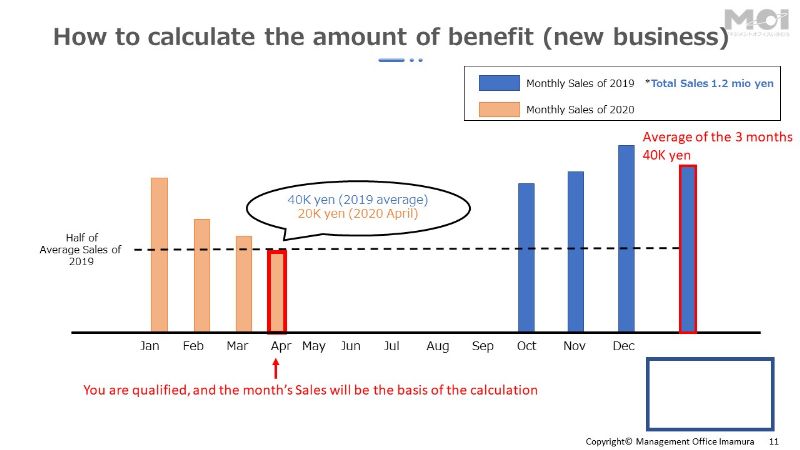

- Those who, suffer from Sales (or turnover) decrease less than half in a month of 2020 compared to the same month of 2019, are qualified.

- The paid money can be used in any uses.

- The program is carried out by the government's extra budget of 2020. The budget's amount is 2.3 trillion yen.

- 3rd party (Service Design Engineering Council) is the front desk of the application.

- Basically on-line application. Those who are not well at PC or smartphone may contact the supporting team (to be announced later)

- Cash will be paid approxilately 2 week later after application (unless filling mistakenly)

Which SMEs or persons are qualified?

Sales (turnover) criteria

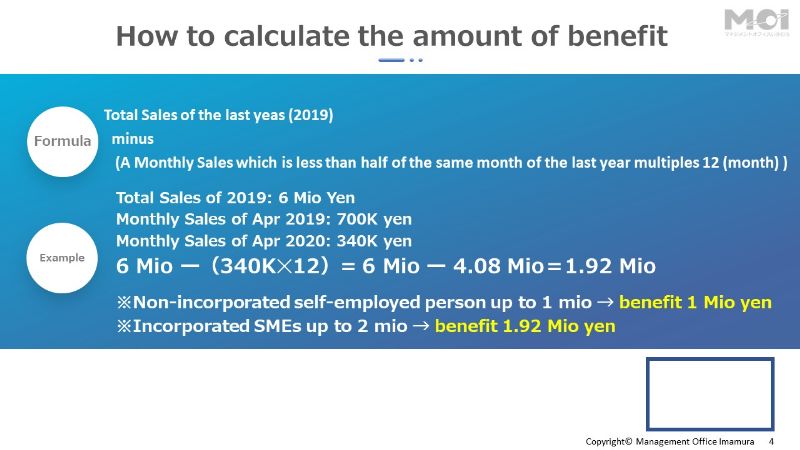

The Government will pay up to 2 million yen for incorporated SMEs or 1 million yen for non-incorporated self-employed persons who fulfill the Sales criteria below.

Criteria

Total Sales of the last yeas (2019) minus (A Monthly Sales which is less than half of the same month of the last year multiples 12 (month) )

Case study

How to demonstrate Sales decrease?

For incoraporated SMEs

- 確定申告書別表一の控え(a reserve document of in-come tax return application form No.1) and 法人事業概況説明書 の控え (2 reserve documents of corporates business overview briefing). (2枚). 確定申告書別表一の控え(a reserve document of in-come tax return application form No.1) must be stamped with the date of reception. For those who submitted these documents on-line (by "e-Tax"), you need to attach 受信通知 (Nofitication of receipt)

- A document which shows the monthly Sales of 2020 which is less than half of the same month of the previous year. i.e. a bookeeping document like Sales ledger.

For non-incoraporated self-employed persons

- Blue return

- 確定申告書第一表の控え(a reserve document of in-come tax return application form No.1 of 2019) with the stamp of the date of reception. For those who submitted these documents on-line (by "e-Tax"), you need to attach 受信通知 (Nofitication of receipt) and

- 所得税青色申告決算書の控え (2 reserve documents of In-come tax Blue return financial statement)

- White return

- 確定申告書第一表の控え(a reserve document of in-come tax return application form No.1 of 2019) with the stamp of the date of reception. For those who submitted these documents on-line (by "e-Tax"), you need to attach 受信通知 (Nofitication of receipt)

- (Both Blue and White) A document which shows the monthly Sales of 2020 which is less than half of the same month of the previous year. i.e. a bookeeping document like Sales ledger.

How to apply on-line?

For those who started the business during 2019

Case study

Official point of contact

Official point of contact

0120ー115ー570 (toll free) or 03-6831-0613

Available everyday from 8:30 to 19:00 (May and June)

Available on weekdays from 8:30 to 19:00 (July)

Available on weekdays from 8:30 to 17:00 (From August on)