On 7/April, Japanese Government annouced to roll out "持続化給付金" or JIZOKUKA-KYUFUKIN, じぞくかきゅうふきん for the companies suffer from Sales decrease due to COVID-19. The Government will pay up to 2 million yen for incorporated SMEs or 1 million yen for non-incorporated self-employed persons where applicable.

In this article, you will see the rough translation of the announcement made by Ministry of Economy, Trade and Industry (METI) on 13/Apri.

The Japanese verson of the announcement is here.

スポンサーリンク

What is "持続化給付金" or JIZOKUKA-KYUFUKIN じぞくかきゅうふきん

For the companies who face a big depression due to COVID-19, the Government will pay benefit where applicable. You may be able to use the benefit widely in your business.

How much money will be paid?

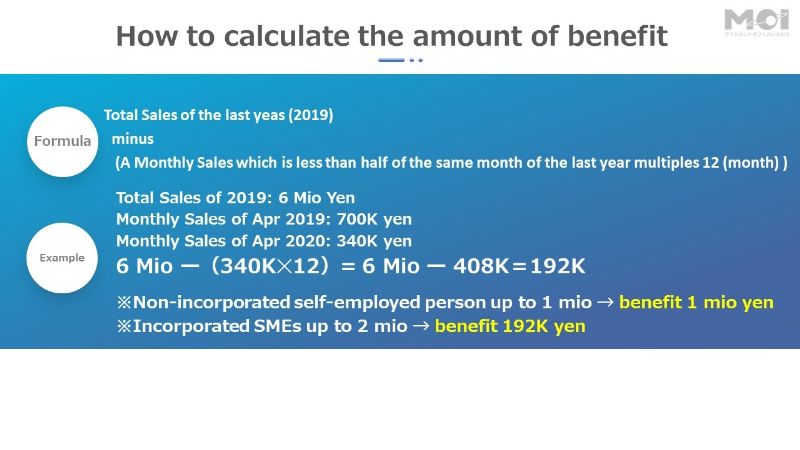

The Government will pay up to 2 million yen for incorporated SMEs or 1 million yen for non-incorporated self-employed persons, wheras it is also up to the decrease from Sales of the last year (2019).

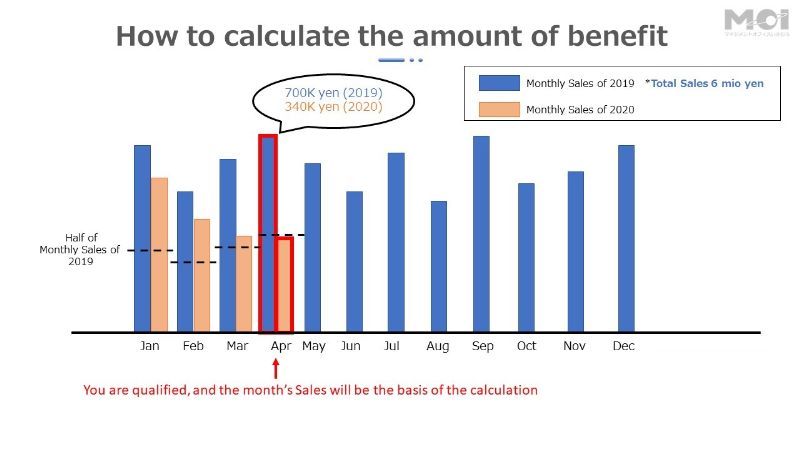

Formula

Total Sales of the last yeas (2019) minus (A Monthly Sales which is less than half of the same month of the last year multiples 12 (month) )

Case study

Who is qualified for the benefit?

- For those whose certain monthly Sales is less than half, compared to the same month of the previous year due to COVID-19

- incorporated SMEs whose Capital amount is less than 1 bio Yen , or non-incorporated self-employed person, including Medical Corporation, Agricultural Corporation, NPO, Social Welfare Corporation etc.

To whom to contact or ask?

0570-783183 (Everyday 9:00~17:00)

(Most likely in Japanese language only)

Frequently Asked Questions

A certain month from Jan/2020 to Dec/2020 whose monthly Sales is less than half. If several months are applicable, you can choose one of them.

Application will start about 1 week after the establishment of the supplementary national budget of 2020. *Planned in late April.

In the case of on-line application, you will be paid about 2 weeks after the application. The benefit will be transferred to your bank account.

- Your Address

- Bank account information (A copy of bankbook with correct name is also necessary)

For incorporated SMEs

- Corporate identification number (you can check here)

- A Copy of documents on Tax Returen of 2019

- A Copy of books which demonstrates the Sales of the month (less than half compared to the previous year) *Any Form is OK

For non-incorporated Self-Employed persons

- A document to identify yourself (e.g. your driver's license?)

- A Copy of documents on Tax Returen of 2019

- A Copy of books which demonstrates the Sales of the month (less than half compared to the previous year) *Any Form is OK

*There may be changes or additions on the information/documents above.

You can apply basically on-line. However, where necessary, you will be able to contact supporting staff located in several cities/towns. You need to make a reservation when you contact these supporting staff.

Further updates

The details are not yet fixed as of 14/Apr. The final annoucement will be made probably in the final week of April by METI.